Understand the basics

Your Investing Foundation

At its core, investing means putting your money to work with the goal of growing it over time. Unlike saving, which focuses on safety and accessibility, investing accepts some level of risk in exchange for potential long-term growth.

Investments can fluctuate in value, especially in the short term. Over longer periods, however, investing has historically been one way people work toward financial goals such as retirement, home ownership, or education planning.

How risky is it?

Different investments offer varying degrees of risk

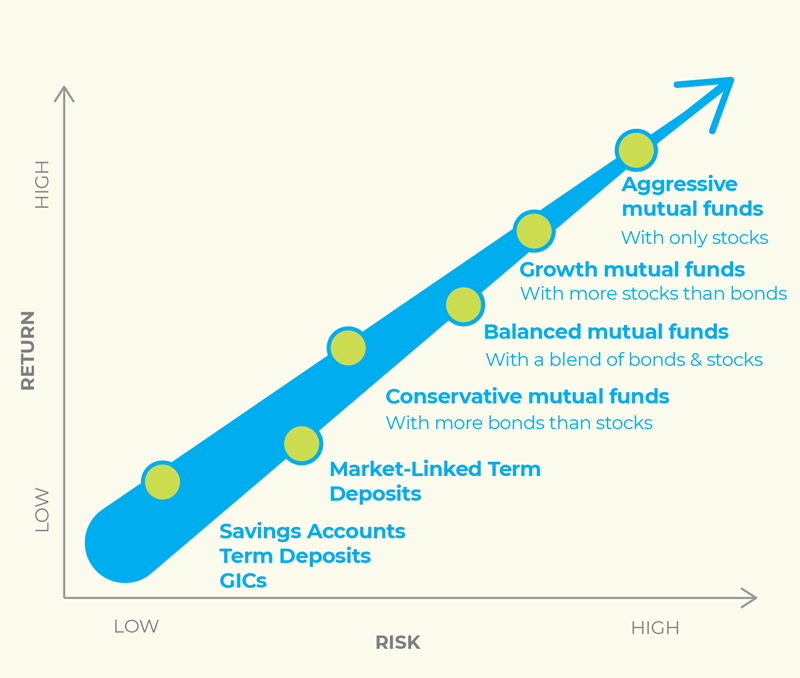

All investments sit on a spectrum of risk. A low-risk investment is more predictable, whereas a high-risk investment means you have the ability to earn more but also have the potential of loss.- Mutual Funds: risk varies depending on the fund's underlying investments. Equity mutual funds tend to be higher risk, while balanced mutual funds generally carry moderate risk.

- Market-linked term deposits: provide exposure to market growth with principal protection, offering moderate risk with capped return potential.

- Cash and cash-equivalents (short term GICs or term deposits, T-bills, money market instruments): the safest investments, but offer the lowest returns

Long-term investment dynamics

Time, Compounding, and Growth

Time has a meaningful influence on how investments grow. Compounding happens when returns are reinvested, so growth builds not only on the money you originally invested, but also on the gains earned along the way.

Because this process takes place over time, longer investment horizons can allow more room for growth and help absorb short-term market ups and downs. This is why many long-term investors tend to focus on staying consistent, rather than reacting to everyday market movements.

Get started

With a registered savings plan

Opening a registered savings account is a great way to start up your investing journey. Each one of these acts as a savings "bucket" where you can choose to simply save your money (with tax benefits) or invest it in a variety of ways including term deposits and mutual funds.

Choose the savings plan right for you. >

Tools & Resources

Personalized Investing

Invest in your future with us. We offer financial plans tailored for you and your life.

Mutual funds

Diversify your investment portfolio. Meet your investment objectives and timeframe.

Qtrade Direct Investing®

We're partnered with Qtrade to offer you an award winning full-service online brokerage.