Develop your own tailor-made plan to identify and achieve your financial goals.

Create a budget

Track your spending for a month

The first step to creating a budget is to track what you currently spend month to month. For an entire month, track everything you spend.

Organize your spending

Fixed and variable-fixed spending reflects what you have to pay month to month. It’s your concrete bills you have and is a set number each month. Your monthly expenses, which can include rent, car insurance, and student loans have a set price. As a result, the amount owed doesn't change, so it is a consistent amount.

Variable-fixed spending are bills or the purchases you make that can vary in amounts owed. These expenses can include your grocery bill, money you spend on clothes, and entertainment (i.e. movies, eating out, concerts, travel, etc.). Your grocery bill one month could be $150 and the next it might be $250. You may need clothes one month and spend $200 and not need to spend money on clothes for a few months. The amount you spend varies.

Review opportunities to save

Once you’ve figured out how much you spend in fixed and variable amounts, go through that information and identify opportunities to save. Ask yourself, did I really need that new pair of shoes? Did I really need to purchase that hair product? Did I really need to eat out as often?

It’s the little purchases that will sneak up on you! For example, if you buy a $5 coffee five days a week for a year, it may seem like you are not spending a lot, however those $5 add up to being $1300 in a year! That money could have been saved by making your own coffee at home and could have gone towards the trip you wanted to have.

Build a healthy credit score

Your credit score

First, let's go over what a credit score is. Our Equifax partners describe a credit score as, “a three-digit number, typically between 300 and 900, which is designed to represent your credit risk, or the likelihood you will pay your bills on time.” This credit score is calculated based on the information in your credit report, which is what most lenders review to determine if and how much they should lend you for large purchases such as a mortgage. It can also affect your ability to travel and where you can get a job.

Build a healthy credit score

Now that you know why your credit score is important, let’s review how to build and maintain a healthy credit score. Here are some good credit building guidelines to live by:

- Start with a credit builder card and know that it takes time to build credit.

View our credit builder cards here > - Apply for credit sparingly.

Speak with an Advisor to determine what this looks like. - Do not use more than 35% of your available credit. For example, if you’re approved for $500 try to stay under $175 at any given time.

- If you have debt, focus on paying it off. The less money you owe, the more you can save.

- Never be late for a payment. Set up automatic, recurring payments to your credit card. This is a good practice for anyone to implement, even if you’re good with remembering to make payments.

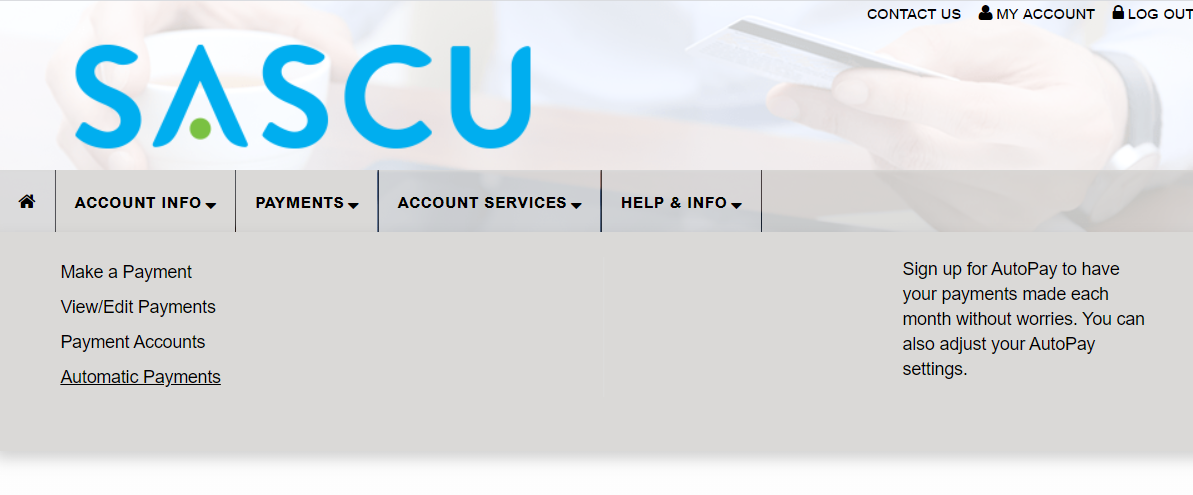

If you have a credit card with us, set up Collabria Auto Pay >

Save for your future

Decide what you want to save for

Are you saving for a car? House? Your child’s education? Maybe, if you’re thinking well ahead, retirement?

Open the right savings account

Once you’ve figured out what you want to save for, make sure you have a savings account that can get you there faster.

Savings accounts pay you interest (a percentage) of what you save. So, depending on the savings account and how much money you allocate to that account, you will earn free money to save!

For example, if you save $1000 and put it in a savings account with automatic payments of $100 a month and the account you have it in pays you 2% for you to have it in there for 3 years, at the end of 3 years that account will have $4,775. That’s a difference of $175 you gain in interest just for having your money sit in a savings account.

Tools & Resources

Discover more

Plan while young

It's never too early to start banking. Learn more about student accounts, educational borrowing, or selecting investments.

Own a home

Home ownership is a dream and responsibility. Learn more about mortgages, home equity line of credits, and planning for renovations.

Plan for retirement

Enjoy the best years of your life. Learn more about preparing a retirement savings plan, insurance, and applying for a pension.